Press Releases

* Please note that the news release contains the content at the time of the announcement and may differ from the latest information.

Real Tech Fund, the world's first and world's only low-temperature low-load, damage-free joining technology

Invested in "Connectec Japan Corporation", which develops semiconductor packaging business

Euglena Investment Co., Ltd.

Euglena Investment Co., Ltd. (Headquarters: Minato-ku, Tokyo, Representative: Akihiko Nagata) is the world's first and world's only low-temperature, low-load, damage-free bonding technology semiconductor as a new investment destination for the venture capital fund "Real Tech Fund". We are pleased to inform you that we have invested in "Connectec Japan Corporation" (hereinafter referred to as "Connectec Japan Corporation"), which develops the packaging * 1 business.

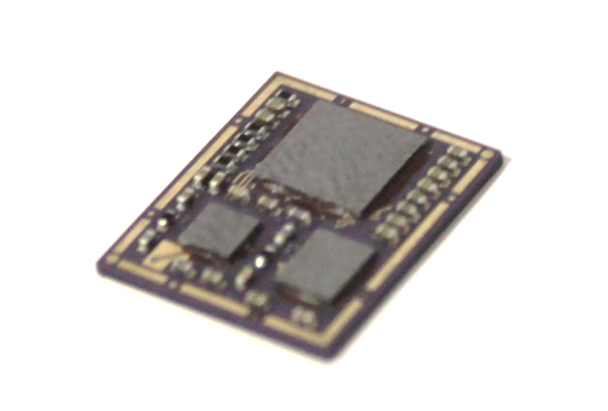

Semiconductor packaging with flip chips from Connectec Japan

The packaging process for commercializing semiconductors includes wire bonding technology * 2 and flip-chip bonding technology * 3, which is used when finer measures are required, but it is the world's first of Connectec Japan. The world's only flip chip that uses low-temperature, low-load, damage-free bonding technology makes it possible to dramatically improve the efficiency of semiconductor packaging.

The existing flip chips used to bond the substrate to the chip at a high temperature of about 260 ° C, but Connectec Japan's flip chip has realized the bonding at about 170 ° C using its own technology. By lowering the temperature, damage to the substrate due to heat is suppressed, and all substrates such as film, glass, and ceramic can be used. In addition, the crimping load at the time of joining can be reduced to about 1/20, so the number of chips damaged by the pressure of the conventional load is drastically reduced, and the yield is greatly improved. ..

In addition, by innovating the semiconductor production process and realizing the entire semiconductor packaging process on the desktop, the factory floor area has been reduced to 1/30 of the huge factory that was conventionally required in the packaging process. We have succeeded in reducing the manufacturing period from 6 days (34 processes) to 2 days (3 processes). As a result, capital investment can be significantly reduced, and it is expected that in the future, with the advent of the full-scale IoT era, it will be possible to solve the problem demands in situations where more diverse semiconductors are required.

This time, the Real Tech Fund will underwrite the shares issued by Connectec Japan through a third-party allotment, and will support the company's research and development, sales and marketing activities.

The details are as follows.

About investment in Connectec Japan Corporation

■ About Connectec Japan Corporation and support contents

| Date of establishment | : November 2, 2009 | |

| Location | : 3-1 Kodancho, Myoko City, Niigata Prefecture | |

| Representative | : CEO Katsunori Hirata | |

| Capital | : 525,266,700 yen (excluding capital reserve) | |

| Description of Business | :半導体パッケージの開発・受託生産業 | |

| HP | : Http://www.connectec-japan.com/ | |

| support | : Promotion of cooperation with fund-funded companies, support for R & D and sales / marketing activities | |

| Timing of investment | : November 2016 |

* 1 Protect the silicon chip with a package. It plays various roles such as ensuring the function and performance of the chip.

* 2 A technology that electrically connects the electrodes on a chip with the electrodes of a mounting board or semiconductor package using wires such as gold and copper.

* 3 A technology that electrically connects electrodes on a chip with a mounting board, etc., using protruding terminals called bumps.

■ About Real Tech Fund (HP: www.euglena-investment.jp)

Our 100% subsidiary of Euglena Investment, SMBC Nikko Securities, Ribanesu "Limited Liability Company was founded three companies Euglena in venture capital funds that SMBC Nikko Ribanesu capital" to management and operation, the investment development of the real tech venture as the main purpose is. With a total of 23 participating companies and a fund size of 7.5 billion yen (as of January 2017), it is Japan's largest fund specializing in real tech. We are investing in and nurturing real tech ventures with the following operating companies that are investors.

Investors: Euglena Investment Co., Ltd., Revanes Co., Ltd., SMBC Nikko Securities Co., Ltd., Nippon Tobacco Industry Co., Ltd., Mitsui Real Estate Co., Ltd., Yoshinoya Holdings Co., Ltd., Rohto Pharmaceutical Co., Ltd., Kanetsu Co., Ltd., Dentsu Co., Ltd., Tokyo Century Kyowa Hakko Kirin Co., Ltd., Aizawa Securities Co., Ltd., Shimizu Construction Co., Ltd., Sumitomo Mitsui Banking Corporation, ANA Holdings Co., Ltd., THK Co., Ltd., Toyo Aluminum Co., Ltd., Daiichi Life Insurance Co., Ltd., CQ Ventures Co., Ltd. , East Japan Passenger Railway Co., Ltd., Japan Unisys Co., Ltd., JCU Co., Ltd., Toyo Spinning Co., Ltd. (23 companies in total, as of January 2017)

-Contact for inquiries from the press-

Euglena Co., Ltd. Public Relations and IR Division